MOHAMMAD ABUL KALAM

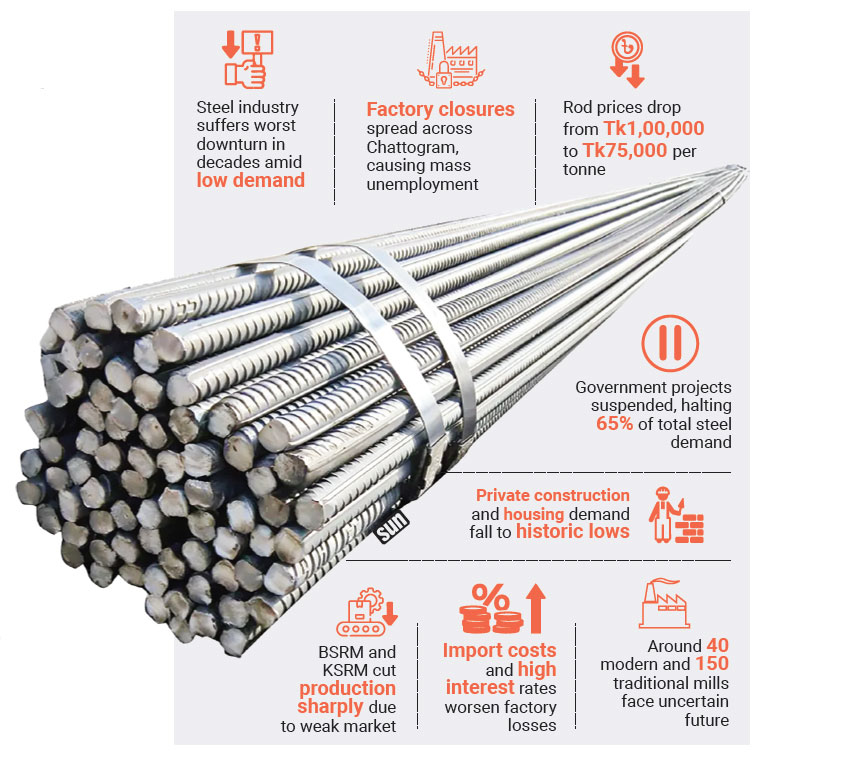

Bangladesh’s steel industry is facing an unprecedented setback due to a sharp decline in both government and private construction projects, weak demand, high bank interest rates, and rising production costs.

Factories are closing one after another in an attempt to minimise losses. The impact has also reached the retail level, with rod sales slowing sharply and prices falling steadily.

According to the Bangladesh Steel Manufacturers Association (BSMA), the retail price of 60-grade MS rods stood at around Tk98,000 to Tk1,00,000 per tonne in June 2024. In just 14 months, that figure has dropped to Tk75,000–Tk80,000 per tonne.

During this period, total demand for rods has fallen by nearly 45%, while production has declined by more than 50% – marking the sector’s worst downturn in decades.

How the Crisis Unfolded

Steel consumption per capita is often used as an indicator of a country’s development. In 2024, Bangladesh’s per capita steel consumption was about 45 kg, with projections suggesting it could exceed 100 kg by 2030.

However, that growth trajectory was abruptly halted following the student-led uprisings of 2024.

Industry insiders explain that after the upheaval, the interim government suspended many large-scale projects initiated by the previous administration. The approval rate for new projects has dropped, and the pace of fund disbursement for ongoing projects has slowed significantly.

At the same time, the private construction and real estate sectors have also entered a slump, directly impacting the steel industry.

Mohammad Sarwar Alam, Director of the BSMA, told the Daily Sun, “Around 62%-65% of domestically produced rods are used by government and autonomous bodies. Right now, demand from this sector has practically dropped to zero. As a result, factories are either halting or drastically reducing production.”

“On the other hand, the 35% demand from private and commercial housing has also fallen to just 10%-15%. The decline in infrastructure spending is the core reason for this crisis,” he added.

Factory Shutdowns and Unemployment

The Golden Steel factory in Sitakunda once produced 600 tonnes of rods daily, employing 550 workers and operating a busy furnace. Today, production has ground to a halt, and the factory has remained closed for over eight months, leaving 450 workers jobless.

Similarly, HM Steel – part of the same group – is operating at only half its capacity, reducing daily output from 1,000 tonnes to just 250-300 tonnes. Consequently, 200 of its 800 workers have lost their jobs.

This situation is not limited to Golden Steel or HM Steel. Other factories in Chattogram – such as Bayazid Steel, Saleh Steel, Seema Steel, Peninsula Steel and Shitalpur Steel – have also either shut down completely or are running at minimal capacity.

Even though the international price of scrap metal has fallen by Tk1,200 per tonne, domestic rod prices have dropped by an average of Tk8,000 in recent months.

BSRM Group Struggles

BSRM, one of Bangladesh’s steel industry pioneers, with an annual production capacity of 25 lakh tonnes of rods and an equal volume of billets, has also been severely hit. The company has reduced production by nearly 12 lakh tonnes over the past year due to weak demand.

BSRM Deputy Managing Director Tapan Sengupta said, “The steel industry, along with many other sectors, depends heavily on the construction sector. Over the past year, rod sales have decreased, and prices have dropped. Investors are under significant pressure.”

“It’s not just government projects; there has been a complete lack of private investment in the construction sector. This has affected even local dealers, who are unable to make payments after purchasing materials because of poor sales.”

Factories Closing but Losses Persist

Sarwar Alam, also Director of Golden Steel, said, “We have invested around Tk700 crore in Golden Steel. Even though the factory is closed, we are still losing about Tk5 crore monthly.”

“Previously, banks required a 10% margin for importing raw materials; now it’s 50–60%. With rising interest rates, the burden of loans has become even heavier. Meanwhile, factories still have to pay monthly bills for gas, electricity, and wages, amounting to Tk5–6 lakh. All of this combined makes it impossible to cover losses,” he added.

Rising Risks for the Sector

The situation is equally grim for KSRM, one of the country’s largest producers, which once produced 2,500-3,000 tonnes of rods daily. That figure has now dropped to below 1,000 tonnes.

Mizanul Islam, media adviser to KSRM, stated, “Demand for rods has fallen by over 50%, and the price doesn’t align with production costs. We are now selling at a loss because we can’t store rods for long.”

“We employ around 8,000 workers, but this situation cannot continue for long. We may be forced to cut jobs in an attempt to minimise losses,” he said.

At present, Bangladesh has about 40 modern steel mills and 150 traditional ones, with an annual production capacity of 1.10 crore tonnes. However, national demand is only 75 lakh tonnes – and even that is no longer being met.

_____________________________

The reporter can be reached at [email protected]