Small entrepreneurs, big impact: The silent struggle of Bangladesh’s small businesses

Mousumi Islam, Dhaka

Published: 26 Jun 2025

In Bangladesh’s dynamic economic landscape, it is not the gleaming high-rises or sprawling factories that drive real progress – it is the millions of small entrepreneurs working quietly behind the scenes. These cottage, micro, small, and medium enterprises (CMSMEs) form the backbone of the national economy, contributing around 32% to GDP – almost twice the contribution made by large industries.

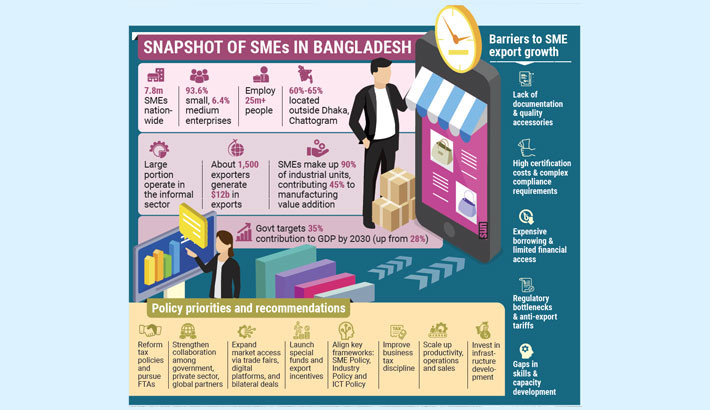

Yet, despite their vital role, CMSMEs remain ensnared in a web of institutional neglect, limited access to finance, bureaucratic red tape, and restricted market reach. For the 7.8 million entrepreneurs – representing over 99% of the country’s industrial establishments and employing 85% of the industrial workforce – the struggle is both constant and uphill.

According to the Bangladesh Bureau of Statistics, CMSMEs employ more than 25 million people, operating across both urban and rural areas. Their activities range from traditional handloom weaving to modern agro-processing, but they all face similar systemic challenges.

Md Mushfiqur Rahman, chairperson of the SME Foundation, highlights their importance: “MSMEs are labour-intensive and require minimal capital. Their short production cycles allow them to make a substantial contribution to national income and employment.”

However, their potential remains largely untapped. Mushfiqur concedes, “The scale of interventions – whether financial, technical, or related to market access – is still woefully inadequate given the sector’s vast needs.”

A credit desert

Access to finance remains the most significant barrier for CMSMEs.

As of December 2024, loans to these enterprises accounted for only 18.4% of total outstanding bank credit. Of the estimated 7.8 million entrepreneurs, fewer than 9% – just 679,524 – secured loans amounting to Tk107,634 crore.

Alarmingly, approximately 91% of CMSMEs remain outside the formal financial system, despite initiatives from Bangladesh Bank, 62 commercial banks, 35 financial institutions, and over 700 microfinance organisations.

For entrepreneurs like Saleha Begum Brishti, a Manipuri “tant” weaver, obtaining finance is a daunting task. “Without subsidised loan schemes, interest rates often hit 16–18%, making it nearly impossible to make a profit,” she says.

The sentiment is echoed by Debashish Sarkar, who runs a bamboo and cane enterprise. “Bank rates are too high. If we borrow from NGOs, the rates are still excessive. Either way, we end up losing.”

Mohammad Hamidul Islam, from the hosiery sector, adds that local banks fail to meet their credit needs, forcing many to turn to informal lenders who charge crippling interest.

Low default, high discrimination

Ironically, CMSMEs have one of the lowest loan default rates in the country – just 3% – in stark contrast to the 60% default rate in the large industry sector. Yet banks consistently favour large firms.

Dr Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (INM) and former Chief Economist at Bangladesh Bank, warns that without targeted support, “the national economy cannot progress properly.” He urges banks to adopt lending models more tailored to small businesses.

Although Bangladesh Bank has directed commercial banks to allocate 25% of total lending to CMSMEs and introduced various low-interest refinancing schemes, take-up remains poor. Procedural obstacles – such as obtaining trade licences, filing annual returns, and securing utility connections – continue to bar entry for many entrepreneurs.

Another growing concern is the rising cost of credit. The weighted average interest rate (WAIR) for SME loans rose from 7.49% in September 2023 to 12.49% by April 2025 – a five-percentage-point surge in less than two years. Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, urged business leaders to mobilise and advocate for reform. He pointed to persistent bottlenecks – including customs delays, inefficiencies at the National Board of Revenue (NBR), and problems with the Registrar of Joint Stock Companies and Firms (RJSC) – as major contributors to the financing crisis.

“With rising operational costs, the old business model is no longer viable. Credit access must become more inclusive – especially for SMEs and the agriculture sector,” he told The Daily Sun.

Inequality in lending

Loan disbursement patterns further reveal the systemic bias. While lending to CMSMEs fell by 3.49% year-on-year in the October–December quarter of FY25, industrial term loans rose by 14.16% in the same period – on the heels of a 57.54% jump earlier.

Stakeholders warn that CMSMEs are now under pressure comparable to that faced by large industries. With shrinking profit margins, drying cash flows, and rising inflation, many small businesses are being forced to close or lay off workers.

“Access to finance is no longer just an economic concern – it’s a matter of survival,” says Dr Zahid.

He recommends introducing simplified, collateral-free loan schemes with relaxed documentation requirements to improve access. He also stresses the need to enforce existing lending quotas for CMSMEs, with strict oversight of bank compliance.

Policy support: A work in progress

Institutional efforts are under way. Bangladesh Bank, in partnership with various organisations, has launched support schemes including collateral-free loans and digital loan processing. However, coverage remains limited.

The geographic imbalance is also glaring: while 70% of CMSMEs operate outside Dhaka, most support remains concentrated in the capital.

Furthermore, official figures may understate the sector’s actual size. Many experts believe the true number of CMSME entrepreneurs exceeds 10 million. This data gap undermines effective policy-making.

Experts agree that reforms must be urgent and multi-faceted – encompassing financial inclusion, policy execution, institutional coordination, digitisation, and improved market access. Dr Zahid Hussain has proposed a comprehensive reform package aimed at unlocking the sector’s potential and resolving the deepening credit crisis. He recommends establishing stronger linkages between CMSMEs and key support systems – including banks, research institutions, and market platforms – to foster sustainable growth.

He also advocates for streamlining bureaucratic procedures through the expansion of digital portals, which could significantly reduce the time and complexity involved in securing licences, approvals, and finance.