Smart savings in uncertain times

How you can secure your finances

M Munir Hossain

Published: 27 Feb 2025

For many Bangladeshis, managing household finances has become a daily struggle. The rising cost of essentials has left families with little choice but to dip into their savings, making the idea of setting money aside for the future seem almost impossible. A simple trip to the market now feels like an ordeal, with prices climbing beyond reach for many. Yet, despite the challenges, financial experts stress that strategic saving and smart financial planning can help people navigate these tough times.

Savings trends amid inflation

The latest data from Bangladesh Bank paints a concerning picture. Between July and November of FY25, net investment in savings certificates stood at Tk1,677 crore. However, just two months earlier, in September, this figure was Tk8,333 crore—a sharp drop highlighting growing financial distress. In November alone, net investment in savings certificates fell by Tk3,431 crore, meaning more people withdrew their savings than invested.

Despite these challenges, many still see government-backed savings instruments as a safe bet. In July and August, net sales of savings certificates were Tk2,187.56 crore and Tk2,036.15 crore, respectively. By September, that number had almost doubled to Tk4,109.09 crore. But the subsequent decline raises a critical question: how long can people continue to invest when everyday expenses keep eating into their earnings?

The battle to save amid inflation

Inflation has been a relentless force. In December 2024, the Bangladesh Bureau of Statistics (BBS) reported that inflation hit 10.89%, with food inflation soaring to 12.92%. This has put immense pressure on households, forcing many to reassess their spending habits.

“In times of inflation, people face immense pressure. Over the past six months, political unrest has only worsened the situation, forcing many to rely on their savings just to survive,” said Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, in an interview with the Daily Sun.

While saving money feels like an uphill battle, financial planners insist that even small, consistent savings can make a difference over time. Setting aside a portion of earnings—even if it’s just a little—can create a financial buffer for future emergencies.

Savings avenues in Bangladesh

Despite economic hardships, Bangladeshis still have several options when it comes to savings. Some of the most viable avenues include:

Savings certificates (Sanchayapatra): These government-backed instruments offer guaranteed returns, making them a reliable option in uncertain times. However, frequent policy changes can affect interest rates and withdrawal conditions.

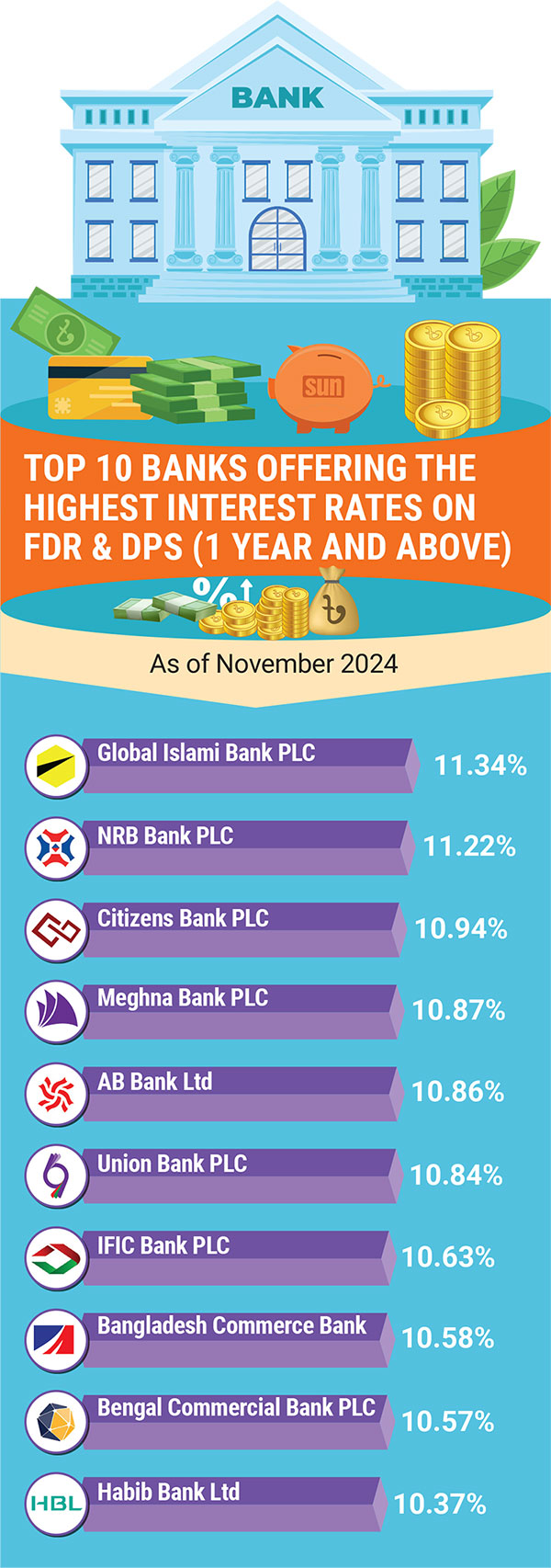

Fixed deposits: Many banks provide fixed deposit schemes with competitive interest rates. While inflation may erode real returns, they remain a disciplined saving mechanism.

Recurring deposit schemes: Offered by banks and financial institutions, these allow individuals to deposit a fixed sum each month, encouraging regular savings habits.

Investment in gold: Many families turn to gold as a hedge against inflation. While subject to market fluctuations, gold has traditionally been a safe store of value.

Mutual funds and bonds: For those looking for higher returns, mutual funds and bonds provide an investment alternative. Though they come with risks, expert guidance can help mitigate potential downsides.

Factors to consider before choosing a savings option

When deciding where to park their hard-earned money, savers must evaluate several key factors to ensure they make the right financial decision. Two crucial considerations are:

Higher interest rate vs institutional stability: While higher interest rates can be tempting, they often come with risks. A financially stable institution with sound fundamentals may offer slightly lower returns but ensures security. Depositing money in poorly managed institutions, even with high interest rates, can lead to potential losses if the institution faces liquidity crises or collapses.

Liquidity and accessibility: Some savings instruments lock funds for a fixed period, restricting access in case of emergencies. Savers should assess whether they need short-term liquidity or can afford to invest in long-term, high-yield instruments.

Government vs private schemes: Government-backed savings schemes like Sanchayapatra offer security and stable returns, whereas private institutions may provide more flexibility and competitive rates. Evaluating the risks and benefits of both options is crucial.

Tax implications and inflation impact: Some savings schemes come with tax benefits, while others may be subject to deductions. Additionally, savers should consider inflation-adjusted returns to ensure their money retains its value over time.

By carefully weighing these factors, individuals can make informed decisions that align with their financial goals and risk tolerance.

Why are people struggling to save?

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), points to food inflation and market inefficiencies as major obstacles. “Despite efforts to control inflation, the prices of essentials remain stubbornly high due to inefficiencies in the system and the unchecked influence of cartels,” she said.

A recent CPD report, “Bangladesh Economy 2024-25: Challenges in Meeting Expectations amid Crisis”, identified several key reasons for inflation. Poor storage facilities, transportation issues, unpredictable weather, and a flawed supply chain have all contributed to rising costs. The report also highlighted hoarding, the dominance of commission agents, and inefficient agricultural practices as major factors behind price volatility.

Practical steps for financial stability

Given the economic uncertainty, experts recommend practical steps that individuals can take to protect their finances:

Smart budgeting: Keeping track of expenses and cutting unnecessary spending can help families free up small amounts for savings.

Avoiding unnecessary debt: Credit card debt and high-interest loans can worsen financial stress. Minimising borrowing is advised.

Exploring additional income sources: Many people are turning to freelancing, small businesses, or part-time work to supplement their income.

Seeking financial advice: Consulting financial advisors or using online tools can help individuals make informed decisions about savings and investments.

What lies ahead?

The current economic uncertainty is forcing many households to rethink their financial strategies. While saving remains crucial, it is becoming increasingly difficult for many. Experts continue to urge people to focus on small but consistent savings to create a financial buffer for future emergencies.

“The dream of setting money aside for the future feels increasingly out of reach,” said a shopper at Karwan Bazar. “Every month, my salary disappears faster than before, and I have to use my savings just to make ends meet.”

As Bangladesh sails across these turbulent times, the hope remains that sound financial planning and informed decisions will help individuals maintain some level of stability. Whether the government can implement effective policies to ease economic burdens remains to be seen, but in the meantime, adapting to the changing financial landscape is key to securing a better future.