From cash to cards: A game changer for easy living

Mousumi Islam, Dhaka

Published: 25 Mar 2025, 12:06 AM

- Muktadir Mokto

Credit and debit cards are steadily gaining popularity in Bangladesh, reflecting a global trend towards digital transactions.

While developed nations have long embraced plastic money, Bangladesh is now experiencing a significant rise in card-based payments, reducing reliance on cash. With increasing digital adoption, the country is moving towards a more modernised financial system.

In all developed countries around the world, credit or debit cards have now become a widely used financial product.

As an alternative to cash, it is often referred to as “plastic money.” If the money spent is paid off on a specific day every month, no interest is charged. Because of this, credit cards are becoming increasingly popular worldwide.

With the rise in credit card usage, cash transactions are decreasing, and the risk of carrying cash is also diminishing.

In 2012, Bangladesh Bank initiated efforts to promote plastic money as part of its vision for a cashless banking system driven by information technology.

To support this transformation, the Payment Systems Department established regulatory frameworks and operational guidelines, leading to steady growth in card-based transactions.

As a result, the number of card users, as well as the volume and variety of card-based transactions, has been steadily rising across the country.

Today, credit and debit card usage in Bangladesh, though lower than in some other countries, is expanding as more individuals and businesses adopt digital payment methods.

There are mainly three types of cards for payments and transactions: debit card, credit card, and prepaid card.

A debit card is a type of payment card issued against the customer’s account, allowing the customer to manage financial transactions by directly withdrawing money from the account.

A credit card is a type of payment card that allows the cardholder to conduct transactions based on a credit limit, which is repayable on a specified date in the future.

A prepaid card is another type of payment card, issued against a deposit of a specific amount. To use this type of card, the customer does not need to have an account with a bank or financial institution.

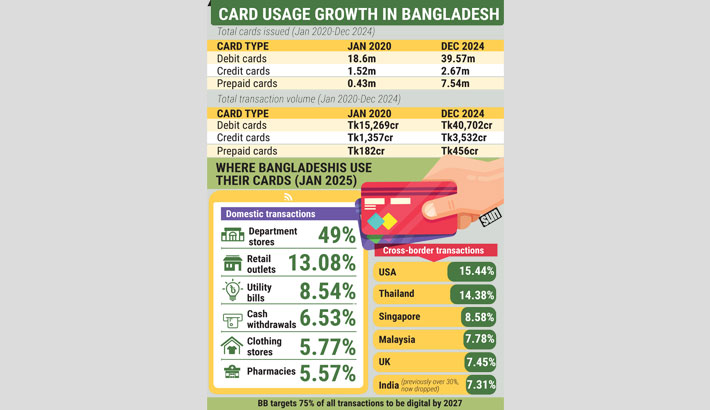

According to a five-year statistical review by the Statistics Department of Bangladesh Bank, the number of debit, credit, and prepaid cards issued as of January 2020 stood at 18,611,681; 1,524,492; and 428,910, respectively. By December 2024, these figures had risen significantly to 39,574,049 debit cards, 2,674,512 credit cards, and 7,544,985 prepaid cards, marking a total growth of 142% across all three categories.

The transaction volume through these cards also saw remarkable growth, increasing from Tk1,68,08 crore in 2020 to Tk4,46,91 crore by the end of 2024 – a rise of 166% in five years. This surge highlights the growing demand for digital transactions among consumers and merchants alike.

To further encourage digital transactions, Bangladesh Bank is actively promoting a ‘less-cash’ society and has set a target for at least 75% of all transactions to be conducted through digital platforms by 2027.

Speaking to the Daily Sun, Bangladesh Bank’s spokesperson and Executive Director Arief Hossain Khan noted that while only a few traditional banks offered credit cards a few years ago, the sector has now expanded significantly, with even Islamic banks entering the market.

Additionally, people’s financial capabilities have increased, leading to a rise in both credit card customers and transactions, he maintained.

Joarder Tanvir Faisal, EVP, head of Cards and Retail Asset at Prime Bank, told the Daily Sun, “The expansion of cashless transactions in Bangladesh reflects a positive change. Both Bangladesh Bank and the government are encouraging digital payments, which will further energise the economy. Cashless transactions not only save time but are also crucial for safe, transparent, and efficient economic management. Our internet banking, mobile banking, QR code payments, and digital wallet services provide customers with convenient and fast transaction options. Banks are also offering various benefits to increase the use of cards.”

The demand for Prime Bank’s cards is steadily increasing, he noted, adding that over the past three years, the usage of our bank’s cards has doubled, reflecting customers’ trust in the bank and the growth of digital payments. “We are continuously taking various initiatives, including educational campaigns, to promote the use of cashless transactions and digital channels in daily economic activities,” he added.

He also said, “To ensure banking services for all segments of society, we are offering corporate prepaid cards, particularly for garment workers who have traditionally received wages in cash. Through partnerships with garment factories, we are bringing workers under the umbrella of universal banking services. Additionally, in areas with limited banking services, our agent banking network plays a key role in issuing debit cards and providing other banking services.”

Different types of cards

There was a time when people had to rely on close friends, colleagues, or relatives for even a small amount of money.

Getting a loan or borrowing money depended on their willingness and ability to help.

If you were fortunate enough to receive it, you could use it to meet your needs or purchase goods and services.

Now, the immediate need for money is being met by credit cards. There’s no need to approach anyone for money anymore, and no one has to know about it.

With a credit card, you can withdraw cash from bank ATMs, as well as make payments for various goods and services.

If the outstanding balance is cleared by a set due date, no interest is charged.

As of December 2024, the number of credit cards issued by banks reached 2,674,512, compared to 1,524,492 in January 2020. The transaction volume also surged from Tk1,357 crore in January 2020 to Tk3,532 crore by December 2024.

Debit or prepaid cards can be used for all types of transactions. In fact, many banks’ debit cards allow payments to be made abroad as well. These cards also offer various discounts when it comes to bill payments. This makes debit and prepaid cards not only convenient but also cost-effective for users.

The number of debit cards rose from 18,611,681 in January 2020 to 39,574,049 in December 2024, with transaction volumes increasing from Tk15,269 crore to Tk40,702 crore during the same period. Similarly, prepaid card usage grew from 428,910 to 7,544,985, with transactions rising from Tk182 crore to Tk456 crore.

Top banks in card issuance

A significant portion of the country’s cards is concentrated in a few banks. In the credit card sector, The City Bank and BRAC Bank are currently the leaders. Following them, Standard Chartered, UCBL, Eastern Bank, Dutch-Bangla Bank, National Bank, SouthEast Bank, and Bank Asia are listed among the top 10 banks.

For debit cards, Dutch-Bangla Bank and Islami Bank Bangladesh hold the top spots, with Bank Asia, The City Bank, Sonali Bank, United Commercial Bank, BRAC Bank, Jamuna Bank, Trust Bank, and Mutual Trust Bank also ranking among the top issuers. These banks offer various benefits such as cashback, discounts, and international transaction capabilities, making digital banking more accessible and convenient.

Credit cards in Bangladesh are widely accepted for international transactions, facilitating cross-border shopping and travel. Visa dominates the market, accounting for 72.11% of transactions, followed by Mastercard at 18.08% and AMEX at 9.57%.

Transactions occurred highest at department stores

Within the country, spending patterns of credit cards across different sectors in January 2025 show that nearly half (49%) of domestic credit card transactions occurred at department stores. Other notable sectors included retail outlets (13.08%), utility bill payments (8.54%), cash withdrawals (6.53%), clothing stores (5.77%), and pharmacies (5.57%).

For international transactions, department stores remained the top category, accounting for 29.72% of spending. Other sectors included retail outlets (16.82%), pharmacies (11.50%), transportation (8.29%), business services (8.03%), and clothing stores (7.00%).

Since the political transition on 5 August 2024, there has been a notable shift in cross-border spending patterns. Previously, over 30% of international credit card transactions were made in India, but this has dropped to 8%. Instead, transactions in the United States and Thailand have increased. As of January 2025, the highest share of international transactions occurred in the USA (15.44%), followed by Thailand (14.38%), Singapore (8.58%), Malaysia (7.87%), the UK (7.45%), India (7.31%), Saudi Arabia (6.81%), the Netherlands (3.90%), Canada (3.84%), the UAE (3.78%), Australia (3.16%), and Ireland (2.68%), with other countries accounting for 14.79%.

With continued support from Bangladesh Bank and growing digital adoption, the country is steadily advancing towards a more cashless economy, positioning itself alongside global trends in financial modernisation.