Banks still shy of agent banking loan disbursement

Most banks have yet to develop feasible infrastructure for loan disbursement and recovery through agent outlets

Daily Sun Report, Dhaka

Published: 21 May 2024, 12:14 AM

Banks’ loan disbursements through their agent

banking window still remain low compared to the collection of deposits.

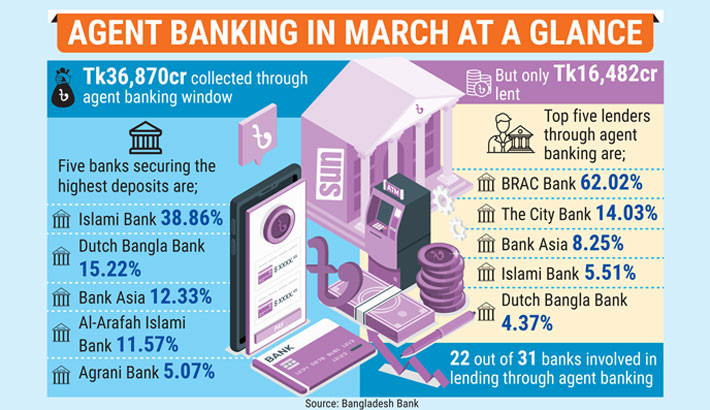

At the end of March, the banks disbursed only a total of Tk16,482 crore under their agent banking system against a deposit of Tk36,870 crore, according to data from the Bangladesh Bank.

The central bank admitted that the volume of lending through agent banking is relatively low compared to the volume of deposit.

It said this is due to the fact that most banks have yet to develop feasible infrastructures for loan disbursement and recovery through agent outlets.

Twenty two banks out of 31 are involved in lending through agent banking in Bangladesh.

Bangladesh Bank says it is closely monitoring the progress and emphasising disbursing loans to rural people to stimulate the rural economy.

According to Bangladesh Bank data, the deposit through agent banking increased by 1.41% in the March quarter from the previous quarter (October-December 2023).

Among the deposits, savings accounts comprise 42.99% of the total deposit while institutions and term deposit make up 51.12% and current accounts 5.89% of the total deposit.

As of March, 31 banks offered agent banking services through 21,613 outlets operated by 15,835 agents.

During the March quarter, the number of agents grew by 0.50% and the number of outlets increased by 0.06% from the previous quarter.

The number of accounts opened through agent banking reaches around 2.23 crore of which about 1.11 crore accounts (49.71%) belong to female customers.

The rural customers own 86.05% (over 1.91 crore) of the agent banking accounts in the country.

Bangladesh Bank introduced agent banking in Bangladesh in 2013 with a view to providing a safe alternate delivery channel of banking services.

The targeted customers for this service were the under-served population who generally live in geographically remote locations that are hard to reach by the formal banking networks.

Customers can avail various banking services including deposits, loans, overseas and local remittances, payment services (such as utility bills, taxes), and receiving government social safety-net benefits through agent banking outlets.

The coverage of agent banking operations in terms of the number of agents and the outlets increases remarkably.

As of March, the total number of agents and outlets reached 15,835 and 21,613 respectively.

The main objective of introducing agent banking was to bring unbanked people of remote rural areas under the umbrella of formal financial services.

As of March, 84.19% of the agents and 85.62% of the outlets were distributed in the rural areas.

As of March, the top five banks secured 83.04% share of the total amount of deposits accumulated through agent banking.

Islami Bank Bangladesh PLC ranked top in this list, with 38.86% of the total deposit amounting to Tk14,328 crore followed by the Dutch Bangla Bank PLC with 15.22% of the total deposit.

Bank Asia, Al-Arafah Islami and Agrani Bank total deposits made up 12.33%, 11.57% and 5.07% respectively.

The top five banks carried out 94.17% of the total lending through agent banking till March.

BRAC Bank topped the list with the largest volume of lending amounting to Tk10,222 crore, which is 62.02% of the total loans disbursed through agent banking.

The City Bank had 14.03% of the total lending followed by Bank Asia with 8.25%, Islami Bank 5.51% and Dutch Bangla Bank 4.37% respectively.