REWIND 2024

Rising foreign debt sparks economic crisis fears

This year, Bangladesh has spent a record about $4 billion on foreign debt repayments, including around $1.5 billion just to pay interest.

Bangladesh is facing mounting economic challenges in 2024 as the pressure to repay foreign debt surges, driven by high-interest loans taken during the tenure of the ousted Sheikh Hasina government and a sharp decline in foreign exchange reserves.

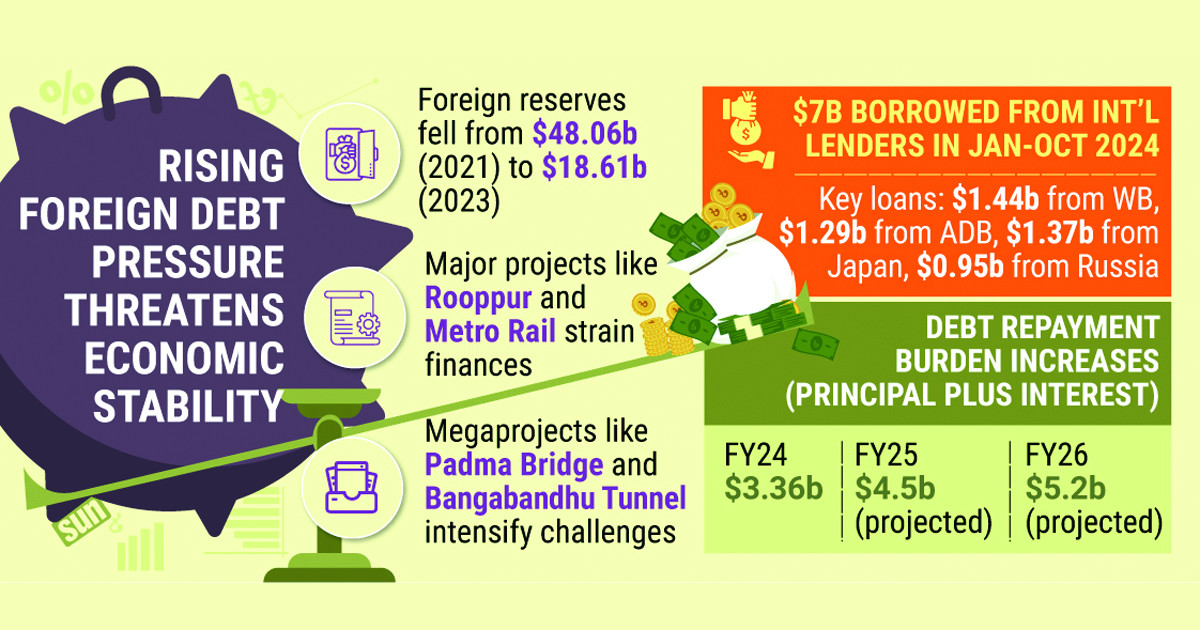

Ahead of the last general election, the government’s leaders and affiliates allegedly laundered large amounts of money abroad, causing Bangladesh's foreign exchange reserves to drop sharply from $48.06 billion in August 2021, the highest in history in the country to just $18.61 billion in last November.

As a result, the country has faced a foreign exchange crisis, leading to uncertainty over debt repayments.

Senior official of the Economic Relations Division said, in 2024, Bangladesh has spent a record about $4 billion on foreign debt repayments, including around $1.5 billion just to pay interest.

Furthermore, as interest rates on international loans have reached 6%, the amount of interest payments has increased, they added.

The government’s tendency to take foreign loans under the guise of economic development since 2008 has led to an increasingly difficult debt situation, with the pressure of repaying loans for large projects now coming to the forefront, they mentioned.

This pressure is expected to grow even further when loan repayments for major projects like the Rooppur Nuclear Power Plant and the Metro Rail project begin in 2024, the officials said.

Economists have warned that foreign debt is on the rise in Bangladesh, and so is the burden of repayment. In the last fiscal year, the country had to repay $3.36 billion in principal and interest, and in the current fiscal year, this figure could rise to nearly $4.5 billion.

According to the Economic Relations Division (ERD), the amount is expected to increase to $5.2 billion in FY26.

Dr Zahid Hussain, former lead economist of the World Bank’s Dhaka office, has stated that if the country’s revenue collection does not increase and foreign exchange supply does not improve, the pressure of debt repayments could lead to an economic crisis.

Particularly, the repayment burdens of megaprojects like the Padma Bridge, railway connections, and the Bangabandhu Tunnel are gradually intensifying, which will have a ripple effect on the overall economy, he added.

Additionally, Bangladesh has borrowed from various international lenders, and in the current year alone, $7 billion in foreign loans have been disbursed during January-October 2024.

These loans have come from institutions such as the World Bank ($1.44 billion), ADB ($1.29 billion), Japan ($1.37 billion), and Russia ($0.95 billion). However, along with debt repayments, the amount of these loans is expected to rise in the coming years, presenting a significant challenge to the country's economy.

Additionally, foreign loan commitments of $4 billion have been made in the same period, including $1.21 billion from the World Bank.

As the pressure to repay foreign debt and interest mounts, economists emphasise the need for the government to take stringent economic measures.

Without enhancing debt repayment capabilities, increasing revenue collection, and ensuring a stable supply of foreign currency, the country may face a severe economic crisis.