5 Key Reasons Now is the Best Time to Invest in Bangladesh

Despite political uncertainty, Bangladesh is an emerging economy in Asia with a vast number of young people, writes Praava Health CEO Sylvana Quader Sinha in Forbes

Daily Sun Report, Dhaka

Published: 25 Sep 2024

Bangladesh has grown faster over a longer period of time than even China. - Bank data

Bangladesh’s economy continues to present a prime opportunity for value-based investors, despite recent political upheavals.

Sylvana Quader Sinha, the founder and CEO of Praava Health, outlined in a recent Forbes article why this moment is ripe for investment in Bangladesh, emphasizing that the country’s economic fundamentals remain strong and promising, even amid political uncertainty.

According to Sinha, the recent ouster of Prime Minister Sheikh Hasina after fifteen years in power may deter some investors. However, seasoned value investors see this as an opportune time to invest.

The following are five reasons she cited in her article why now is the ideal time to consider Bangladesh:

1. Strong Economic Fundamentals

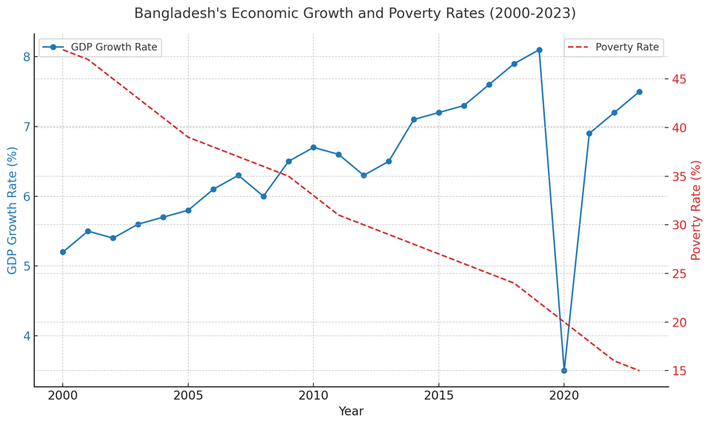

Sylvana Sinha notes that Bangladesh has consistently maintained one of the fastest-growing economies globally, with growth rates of 6-7% annually over the past few years. In her article, she highlights that Bangladesh’s GDP per capita has surpassed India’s and that HSBC projects the country to become the world’s 26th largest economy within the next decade.

Despite being largely reliant on its thriving ready-made garments (RMG) sector, which is the second-largest in the world after China, Bangladesh has been diversifying its economy into sectors such as pharmaceuticals, electronics, shipbuilding, and agro-processing. Sinha points out that Bangladesh’s young population, with over half under the age of 25, also contributes to the country’s dynamic labor force, ready to drive future growth.

Further, Bangladesh has made substantial progress in reducing poverty, raising literacy rates, and improving healthcare. “Poverty levels have fallen dramatically, with extreme poverty affecting less than 10% of the population,” Sinha writes, noting that Bangladesh’s performance on social development indicators outpaces other countries in the region.

2. Commitment to Reform and Anti-Corruption Efforts

The change in political leadership, spearheaded by a youth-led movement, signals a new era of governance focused on reforms and accountability. Sinha notes that the caretaker government, led by Nobel Laureate Professor Muhammad Yunus, is committed to tackling corruption and improving governance. This is likely to create a more transparent and investor-friendly environment, with measures already being implemented to support these reforms.

She also highlights that the World Bank has committed USD 2 billion to aid the government’s reform agenda. International organizations like the IMF, the Asian Development Bank (ADB), and Japan International Cooperation Agency (JICA) have also pledged support.

Additionally, the Bangladesh Bank, the country’s central bank, has tightened its regulations on loan disbursements and is scrutinizing non-performing loans (NPLs). According to Sinha, anti-corruption measures are also being strengthened, with the Anti-Corruption Commission (ACC) empowered to investigate high-profile cases.

3. Bangladesh’s Market Size and Global Recognition

Sinha references a BCG report, stating that Bangladesh’s GDP is currently about USD 450 billion and is expected to exceed USD 750 billion by 2029. “The size of the market, along with the potential it holds, makes Bangladesh a key player in the global economy,” she writes. HSBC also projects that Bangladesh will become the 26th largest economy by 2030, while PricewaterhouseCoopers (PwC) ranks it among the fastest-growing economies in the world.

This massive consumer market is set to draw more foreign investments as it continues to grow, driven by increasing consumption demand and a burgeoning middle class.

4. Opportunity Amid Instability

Sylvana Sinha stresses that political instability often creates undervalued opportunities for long-term investors. With the current political transition, Bangladesh’s market is experiencing a pricing gap that astute investors can take advantage of. Bijon Islam, CEO of Lightcastle Partners, is quoted in the Forbes article, stating that the recent changes are creating favorable conditions for those willing to enter the market now, with reforms expected to boost the long-term prospects of the economy.

Sinha echoes this sentiment by quoting Robin Butler of Sturgeon Capital, who says, “Business is never ‘normal’ in a developing economy, so most companies are well placed to handle the current dislocation.” The article emphasizes that Bangladesh remains resilient and poised for long-term success, despite current uncertainties.

5. Long-Term Investment Potential

Emerging markets like Bangladesh require a long-term investment approach, Sinha asserts. Investors who enter now, during a period of political and economic transition, stand to gain significantly in the future. She draws a parallel to India, where early institutional investors have seen their investments multiply over the past two decades.

“While political risk is always a factor in emerging markets, Bangladesh’s investment prospects remain better than comparable economies in the region such as Egypt, Nigeria, or even Pakistan,” Sinha writes. Saif ul Islam, President of the Dhaka Stock Exchange Brokers Association, believes that the current interim government will create a more investor-friendly environment by addressing corruption and reducing business costs.

In conclusion, Sylvana Sinha argues that Bangladesh’s economy is poised for continued growth, and now is the ideal time for investors to enter the market. With strong fundamentals, a commitment to reforms, and the potential for significant returns, Bangladesh remains a highly attractive investment destination in the region.