Close down irreparable banks, save govt funds: CPD

Those banks are on the verge of collapse and continuing their operation is just a waste of government fund.

Daily Sun Report, Dhaka

Published: 13 Aug 2024

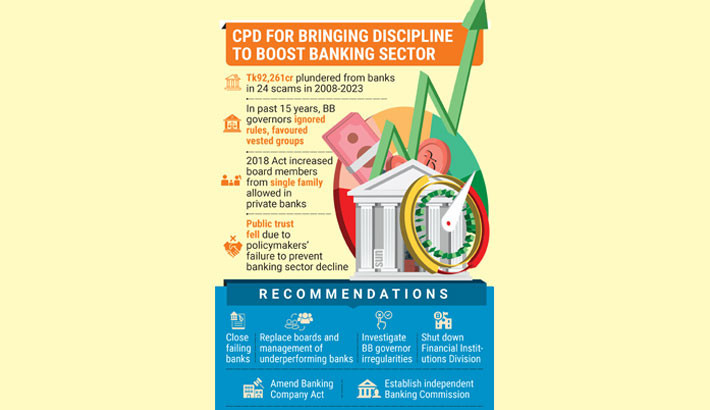

The Centre for Policy Dialogue (CPD) has urged authorities to close down some third and fourth generation banks which gained licences using political influences during the Awami League regime and were kept alive with bailouts despite becoming clinically dead.

Those banks are on the verge of collapse and continuing their operation is just a waste of government fund, said CPD in programme titled, “Bringing Discipline in the Banking Sector: What Should be Done Immediately” at its office in the capital on Monday.

Aside from the irreparable ones, some banks are performing poorly and they will fold if they get a little shock. Those banks can be kept alive by changing their boards of directors and managements, said the independent think tank.

CPD said the entire banking sector has gone beyond regulation. The Bangladesh Bank has worked for the development of a number of particular individuals and groups for so long.

It recommended forming a banking commission to identify and resolve problems in this sector.

Besides, a dual administrative system is going on in the banking sector which is harming it. The Financial Institutions Division of the Ministry of Finance should be closed to remedy the problem, said CPD.

Apart from this, the culture of giving licences for banks without scrutinising the applications properly should also be eradicated, it added.

Tk92,261cr embezzled in 15 years

At the event, CPD Executive Director Fahmida Khatun said around Tk92,261 crore has been plundered from the country’s banking sector in 24 major scams over the past 15 years – from 2008 to 2023.

The embezzled amount is equivalent of 12% of the country’s budget for fiscal year 2023-24 or 2% of the country’s gross domestic product.

CPD said a business conglomerate in the country, which owns seven banks, alone embezzled Tk30,000 crore from the Islami Bank, which was once performing very well.

Between 2014 and 2016, around Tk236 crore was laundered using another bank’s offshore banking services. From 2009 to 2013, around Tk4,500 crore was embezzled from another bank through fake companies and dubious accounts, said the research organisation.

Apart from this, a state-owned commercial bank has given Tk10,000 crore loan to a business group violating the loan limit policy for a single customer.

“If a single group gets so much money, what other customers will get,” asked CPD.

BB doesn’t take decisions independently

Regarding the independence of the Bangladesh Bank (BB), Fahmida Khatun said it is not that the regulatory body does not have freedom; they are just not using it. The central bank only thinks of some special groups’ interests when they make policies.

In the last 15 years, the Bangladesh Bank governors have helped a number of vested groups either by ignoring the existing rules or by changing the laws to favour them, said CPD.

In 2013, the government approved licences for nine new private commercial banks owned by politically influential people, including a former mayor.

These instances should be investigated and concerned governors should be made accountable.

In 2018, the Bank Company (Amendment) Act increased the number of members of a single family allowed in a private bank’s board of directors from two to four. In 2023, this was reduced to three, but the tenure of directors was increased to 12 years.

The Banking Company Act should be amended so that there is only one member from a family on the board of directors, and the tenure of each director should be limited to three years, with each director being allowed to serve a maximum of two terms in their entire lifetime, said CPD.

Recommendations for immediate action

CPD said people’s trust in the banking sector has plummeted due to the continuous deterioration of this sector’s health and former government policymakers’ inadequate measures to prevent the crisis. Sporadic measures were not successful since the nature and depth of the problem require a comprehensive approach with due diligence and structural reforms. In addition to that, reforms must be backed by political will as there will be resistance from the vested interest groups.

A goal-specific, time-bound, transparent, unbiased, inclusive and independent Banking Commission should be formed to ensure transparency in this sector, identify the root causes of the manifest problems, and suggest credible measures for improving the situation sustainably, recommended CPD.

Moreover, commercial banks need to be strengthened. The independence of the Bangladesh Bank should be upheld. A legal and judicial environment conducive to ensuring justice should be created and integrity and availability of timely data should be ensured, it added.