Taming inflation, boosting growth – A daunting task

If there is no growth, there will be no employment

Mousumi Islam, Dhaka

Published: 31 May 2024

The cost of living has spiralled out of control, putting people – especially the low-income group – in an extremely difficult situation, while the repeatedly changing policies implemented by the authorities have failed to resolve the crises in the economy.

The growth of the country’s gross domestic product (GDP) declined as production in different sectors, including industry and agriculture, dropped in the outgoing FY24 due to the general economic recession, while the inflation rate remained way above the target set by the government.

In this difficult situation, Finance Minister Abul Hassan Mahmood Ali will present the FY25 budget on 6 June with a message of relief. However, there are concerns about achieving expected GDP growth and controlling inflation despite setting moderate targets in these regards, said experts as well as economists.

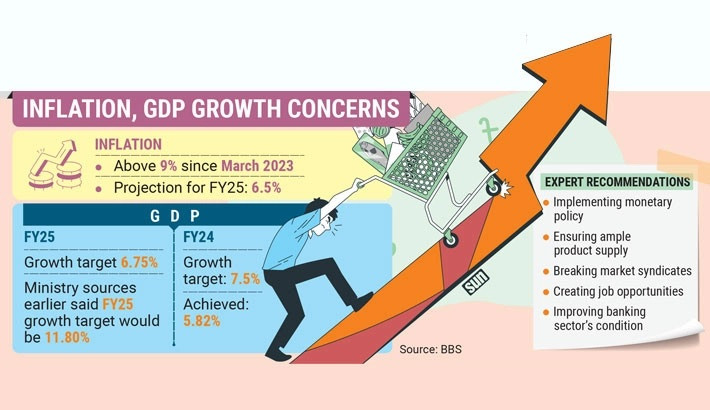

Former Chief Economist of Bangladesh Bank Dr Mustafa K Mujeri said monetary policy plays a key role in controlling commodity prices, but regulating the market is not possible through monetary policy alone. For this purpose, ensuring ample supply of products and breaking syndicates in the market are necessary.

Analysts said inflation control is the main challenge now, but if there is no growth, there will be no employment.

Dr Ahsan H Mansur, executive director of Policy Research Institute (PRI), told the Daily Sun, that the reserves have decreased and the inflationary pressure has increased due to the dollar crisis. The headline inflation has been above 9% since March last year, but the government planned to keep it within 6% in the current fiscal.

“Our growth will not come easily, because the condition of our banking sector is very bad. That has become a big problem,” he added.

Taming inflation seems challenging

Inflation has been running high for more than a year and a half, forcing people to spend more than their income. The Bangladesh Bank took an initiative to control inflation by increasing the commercial banks’ lending rates, but that formula did not work.

The Consumer Price Index (CPI) based on year-on-year headline inflation during the January–March period of 2024 hovered around 10%, while the food and non-food inflation also maintained higher trajectories.

In April, the overall inflation rate was 9.74%, and the food inflation rate is 10.22%. According to Bangladesh Bureau of Statistics (BBS) data, inflation was 9.81% in March, 9.67% in February, 9.86% in January this year, and 9.41% in December, 9.49% in November last year.

The inflation rate was 9.33% in March 2023, while it was 6.15% and 8.84% in 2021–22 and 2022–23, respectively.

In April 2020, the Bangladesh Bank fixed the maximum interest rate on bank loans at 9%. However, when the country’s economy faced a crisis due to the pandemic and the onset of wars in different countries, the central bank introduced the new SMART rate – six-month average interest rate of 182-day treasury bills – to determine the interest rate of bank loans from July last year. The interest rate in July 2023 was 10.10%. Due to the SMART rate, interest on loans crossed 13.50%.

Then, in the first week of May the Bangladesh Bank scrapped the SMART rate formula after about a year and returned to the market-driven system after four years.

The government aimed to bring down the inflation rate to 6% in FY24.

In the budget speech last year, former finance minister AHM Mustafa Kamal said, “Inflation will be very controlled in the next fiscal year (FY24) due to the decrease in the price of fuel, food products and fertilisers in the world market, adjustment of fuel oil prices in the country and government initiatives to keep the food supply situation normal.”

Recently, Finance Minister Abul Hassan Mahmood Ali also told reporters in his office that one of the main targets of the next budget is to bring inflation under control. In this case, the aspect of giving relief to the people will be important. Along with reducing the price of goods, there will be steps to bring low-income people under a support programme.

Boosting GDP poses challenge despite moderate target

The country’s GDP witnessed a lower growth in the outgoing FY24, compared to the target set for the fiscal year. Production growth in industry, and agriculture sectors declined in this fiscal due to the general economic recession. Consequently, the target for a moderate growth is set for the next budget.

However, to become an upper-middle-income country, there is no alternative to increasing production. Ensuring employment is also important in this regard.

In his budget speech last year, ex-finance minister AHM Mustafa Kamal said the world was making a turnaround as the COVID-19 pandemic was over, so production will increase in the coming days. However, production in different sectors, including agriculture and industry, dropped throughout the fiscal year.

According to BBS, production growth in the agriculture sector in FY23 was 3.37%, which is projected to drop to 3.21% in the outgoing FY24. The industrial sector’s production growth dropped to 6.66% in FY24 from 8.37% in FY23.

The growth of the service sector has increased slightly over the last fiscal year. In FY24, the growth of this sector was 5.80%, which was 5.37% in the previous fiscal year.

The GDP in the current fiscal is expected to reach around Tk5.90 lakh crore. Accordingly, the GDP growth rate will be set at 6.75% for FY25, said sources at the finance ministry.

Earlier, sources at the Ministry of Finance said the government would like to increase GDP growth to 11.80% in FY25 compared to the current fiscal year.

However, the government wants to fix a moderate and cautious GDP growth target for the upcoming fiscal as the overall economic situation is not favourable. Lack of easy availability of dollars, capital equipment import controls, and high bank interest rate has made the economic condition difficult, said economists.