5 banks account for 45% of NPLs at Sept end

Total defaulted loans in the banking sector stood at Tk155,398 crore as of September last year

Mousumi Islam, Dhaka

Published: 30 Apr 2024

Only five banks out of total 61 in the country accounted for 45% of all non-performing loans (NPLs) at the end of the third quarter of 2023, according to a Bangladesh Bank report.

The “Financial Stability Assessment Report – July-September” unveiled by the central bank on Monday, however, did not mention the names of the banks.

The ratio of the banking sector’s NPLs to the total loans declined by 0.18 percentage point compared to the April-June quarter of last year to reach 9.93% at the end of July-September quarter.

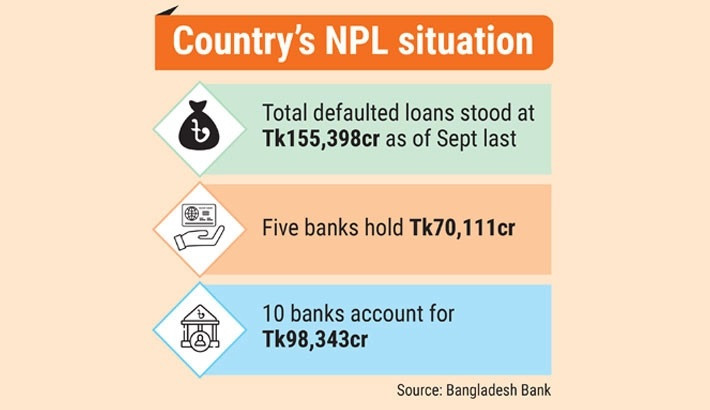

Total defaulted loans in the banking sector stood at Tk155,398 crore as of September last year .

The NPL of the top five banks stood at Tk70,111 crore and that of the top 10 banks was Tk98,343 crore at the end of last year’s third quarter. At end-September 2023, the top five and top 10 banks' NPL concentrations were 45.12% and 63.28%, respectively, according to the central bank report.

The report said despite the decline in NPLs concentration among the top five and the top 10 banks, it is still a concern for the overall banking industry.

Dr Zahid Hussain, former lead economist of the World Bank’s Dhaka office, told the Daily Sun that, “The NPLs the Bangladesh Bank reports are much lower than the actual NPLs. We have implemented a liberal model to control NPLs.

Opportunities – like, loan rescheduling and regularisation from one-time default by paying a little – were given repeatedly, but defaulted loans increased instead of decreasing.

“If we do not come out of this policy, defaulted loans cannot be reduced. Time has come to be strict with large and repeat defaulters. The law must be applied even-handedly to all. No new loan should be given to the defaulting individuals and institutions.”

According to the central bank’s report, at the end of the July-September quarter last year, 25 banks maintained the NPL ratio below 5%, showing a slight decrease from the 28 banks within the same NPL range in the previous quarter. Furthermore, at end-September 2023, the number of banks having NPL ratio greater than 20% remained at 9.

The proportion of “bad and loss” category loans within the total NPLs increased at end-September 2023 and continued to comprise the major portion of total NPLs. The bad and loss category was 87.72% of total classified loans at end-September last year, while “substandard” and “doubtful” loans were 8.02% and 4.26%, respectively, of total loans.

In its report, the central bank said state-owned commercial banks, specialised banks and private banks had the highest NPL rate, with state banks accounting for one-fourth of the total defaulted loans.

The Bangladesh Bank’s financial stability report said in the third quarter of 2023, the banking sector’s capital to risk-weighted asset ratio (CRAR) decreased slightly compared to the preceding period. The CRAR stood at 11.19% at the end of June 2023, which declined to 11.08% at the end of the July-September quarter that year. However, the maintained CRAR was above the minimum regulatory requirement of 10%.

According to the report, 51 out of total 61 banks maintained CRAR of 10% or higher during the reviewed quarter. At end-September last year, 25 banks held CRAR ranging from 10% to less than 15%. However, there were 10 banks with less than 10% CRAR held.

During that quarter, the Foreign Commercial Banks (FCBs) had the highest CRAR – 35.72%, – whereas the specialised development banks (SDBs) had the lowest CRAR amounting to -38.91%.

In the report the central bank said, “According to the pre-shock scenario, 10 out of 61 scheduled banks could not maintain the minimum regulatory requirement of capital to risk-weighted asset ratio (CRAR) of 10% at end-September 2023.

If NPLs increased by 3%, then five banks would fail to maintain the minimum required CRAR. If the top three borrowers of each bank defaulted, then nineteen (19) banks would fail to maintain the minimum required CRAR. If existing NPLs shifted to downward categories by 5%, then two (02) banks would fail to maintain the minimum required CRAR.”