Paychecks shrinking, lives straining

Soaring living costs push people on the edge

Published: 22 Feb 2024

Imagine living paycheck to paycheck, but every month your paycheck buys less and less. That is the harsh reality for millions in Bangladesh, where soaring inflation is outpacing income growth, squeezing families and fuelling financial despair.

Data reveal a widening gap between rising costs and stagnant wages, with experts calling for urgent action to ease the burden on the citizens.

Jahidul Islam, a private sector employee residing in Kallyanpur, Dhaka, expressed his frustration, saying, “Managing my salary amidst the rising market costs has become difficult. I’ve already made significant cutbacks, but there’s no more room to tighten my budget.”

“Consequently, I’m compelled to relocate my family to Atibazar, Keraniganj, just outside the main city.

To sustain my family, I now resort to taking loans ranging from Tk5,000 to Tk10,000 every month.”

Another resident from Mohammadpur, Iqbal Mahmud, told the Daily Sun a tale of financial strain, “I used to live with my family in a sublet rental until last December. However, due to stagnant salary at Tk30,000 per month and rising expenses at Tk40,000, I’ve accumulated debts of Tk2-3 lakh over the past five years.”

He added, “The prices of essential commodities are soaring, leading to daily arguments with my wife over grocery shopping. Unable to find a way to boost my earnings, I had no choice but to reduce expenses by sending my family to the village.”

Millions of individuals, like Mahmud and Islam, confront daily hardships due to the escalating prices of essential goods. However, their wages remain stagnant, exacerbating their financial predicament.

An analysis of the Bangladesh Bureau of Statistics (BBS) data reveals that people’s expenses are rising at a faster rate than their wages.

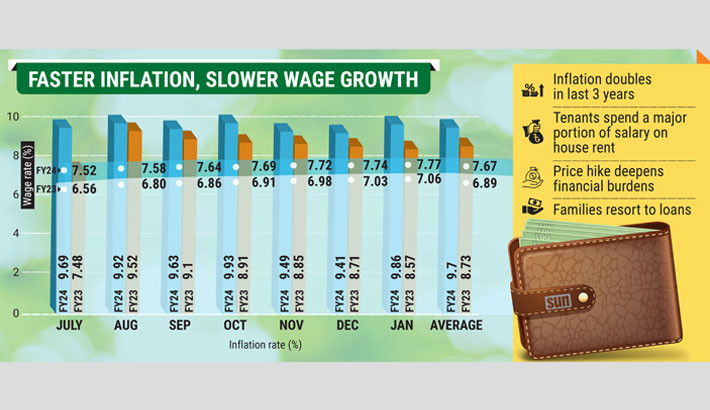

During July-January of the current fiscal year, the average inflation rate stood at 9.70%, exceeding the average wage growth rate of 7.67%. This trend has persisted over the last three and a half years, with the inflation rate doubling while people’s incomes stagnate.

The inflation rate was 5.56% in FY21, 6.15% in FY22, and 9.02% in FY23, respectively, while the wage growth rate was 6.12% in FY21, 6.06% in FY22, and 7.04% in FY23, respectively.

There is approximately a 2% gap between the inflation rate and the wage growth rate, according to BBS data. The inflation rate, however, is rising at a faster pace compared to the wage growth rate.

Meanwhile, BBS’s House Rent Index (HRI) reveals a 5.89% surge in national house rents from October to December, slightly up by 0.03% from last year.

The Consumer Association of Bangladesh (CAB) reports a staggering 628% increase in house rent over the last 15 years.

In a survey on house rent in the capital conducted over 25 years, the organisation found that house rents have surged by nearly 400%, while the prices of daily commodities have risen by 200%. This indicates that the rate of increase in house rent is twice that of the price of daily commodities at present.

Additionally, the organisation’s data shows that 27% of Dhaka’s tenants spend around 30% of their income on rent, while 57% spend about 50%, and 12% spend roughly 75%.

Speaking to the Daily Sun, Dr Zahid Hussain, former lead economist of the World Bank’s Dhaka office, said, “Inflation in the country has increased a lot, it needs to be reduced. Inflation cannot be controlled by policies; we need to increase the dollar supply.”

“If the dollar supply increases, it will be easier to import the desired goods. It will keep the market under control. On the other hand, we have to increase our investment in various sectors, then job opportunities will be created. Increasing production and market monitoring should also be strengthened” he said.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue (CPD), emphasised the urgent need to control inflation to mitigate the declining purchasing power of the people, especially those with fixed incomes.

Inflation should be brought below 8% to alleviate the financial burden on citizens, he added.

“The decreasing purchasing power has led individuals to adjust their expenditures by cutting costs on essentials such as rent, food, and education.”

The government should implement initiatives aimed at bolstering investments and production, he said.