SIM-lock policy

Bangladesh moves to boost smartphone access for marginalised communities

Published: 04 Nov 2025

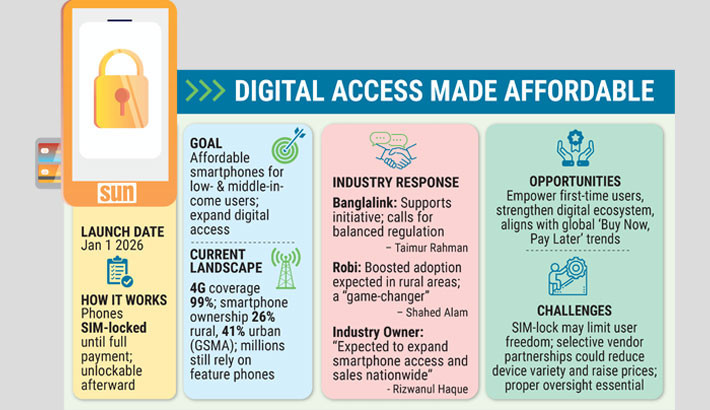

In a significant step to accelerate smartphone adoption, the Bangladesh Telecommunication Regulatory Commission (BTRC) has approved a new framework allowing mobile operators to sell smartphones on installments using SIM-lock technology.

Under the initiative, Grameenphone, Robi, Banglalink, and Teletalk will be able to sell BTRC-approved smartphones with the option to lock all SIM or network slots until installment payments are completed.

The policy, finalised at the commission’s latest meeting, takes effect on 1 January 2026, replacing an earlier 4 June directive that allowed only partial SIM-slot locking.

Industry insiders say the move could redefine smartphone access for low- and middle-income users by easing upfront costs and bringing first-time users into the digital economy.

Despite 4G networks covering 99% of the population, smartphone penetration remains relatively low – just 26% in rural areas and 41% in urban areas, according to the GSMA – leaving millions reliant on feature phones.

Under the new model, telcos can sell smartphones on installment plans with SIM-locks tied to their networks until full payment is made. Once the device is paid off, it can be unlocked for use with any operator.

The BTRC has also mandated user consent, transparent pricing, and customer protection to ensure fair practices.

“We welcome initiatives that help increase mobile phone penetration and bridge the digital divide,” said Taimur Rahman, chief corporate and regulatory affairs officer at Banglalink. “But any scheme must also uphold fair competition and consumer freedom. A balanced regulatory approach is critical to sustain both industry and consumer interests.”

Robi also welcomed the move, calling it a “game-changer” for the tele-com sector. “By enabling affordable devices through installment plans, this initiative will expand access in rural and underserved areas,” said Shahed Alam, chief corporate and regulatory officer of Robi Axiata PLC. “We remain committed to working with BTRC and stakeholders to ensure successful implementation.”

The initiative follows global trends where “Buy Now, Pay Later” models have reshaped mobile device accessibility. Rizwanul Haque, vice-president of the Mobile Phone Industry Owners’ Association of Bangladesh, told the Daily Sun that the framework “is expected to boost smartphone sales and expand access nationwide. With proper implementation of the NEIR system, we can accelerate this transformation.”

Financing platforms such as PalmPay, TopPay, MomoPay, and SohojPay already enable flexible installment plans for brands like TECNO, Infinix, itel, Realme, OPPO, OnePlus, VIVO, and Walton.

Rizwanul noted that these platforms now account for over 20% of total smartphone sales, lowering the entry barrier and driving record local production.

Around 18 companies, including Xiaomi, Samsung, OPPO, Vivo, and Realme, currently operate factories in Bangladesh, contributing to a fast-growing domestic manufacturing ecosystem.

“This could be a turning point for digital transformation in Bangladesh,” said MN Nahid, a Dhaka-based telecom analyst. “But inclusivity, pricing transparency, and device diversity must be prioritised. Telcos must focus on building trust, not just market share. The move can uplift millions, if it empowers users rather than restricts them.”

The BTRC’s directive also outlines safeguards to prevent misuse: opera-tors must work with approved importers or manufacturers, comply with financial and banking rules, protect customer data, and regularly report sales and installment data for oversight. SIM- and device-locking may be applied separately or together, depending on business models.

Potential challenges

While the initiative promises to widen smartphone access, analysts caution against possible pitfalls.

SIM-lock mechanisms, though useful for ensuring payment compliance, could restrict user freedom if pricing, service quality, or after-sales sup-port fall short.

There are also concerns that partnerships with select vendors could limit device choice and drive up prices.

For context, India’s telecom regulator, TRAI, recently warned against misuse of lock-in systems, stressing that user rights and market competition must be safeguarded.

The writer can be reached at: [email protected]

Edited by: Anayetur Rahaman