The glorious rise of Bangladesh’s refrigerator industry

Jannatul Islam Rahad, Dhaka

Published: 22 May 2025

Once considered a symbol of affluence, refrigerators in Bangladesh have evolved into essential household items, especially for ordinary families in rural areas with access to electricity.

The appliance has transitioned from a marker of aristocracy to a practical tool of modern living, reflecting broader socio-economic changes across the country.

Over the past decade, annual demand for refrigerators in the country has nearly quadrupled to approximately 3.5 million units. This sharp rise has been fuelled by increased local manufacturing capacity, rising purchasing power, improved rural infrastructure, and shifting consumer lifestyles.

Today, 13 local and foreign companies are assembling refrigerators in Bangladesh, meeting 95% of the domestic market’s needs. Among them, Walton Hi-Tech Industries stands out as the market leader, controlling over two-thirds of the share and achieving billion-dollar company status. Other significant players include Vision, Konka, Singer, Minister, My One, Orion, LG, Samsung, and Hisense, all vying for a portion of this booming market.

According to a 2023 government survey, 53.4% of Bangladesh’s over 35 million households now own a refrigerator – 70% in urban areas and 48% in rural regions. Still, industry insiders note that companies are far from complacent.

With around one-fourth of households in the lower-middle-income bracket and nearly one in five living below the poverty line, there remains a large untapped segment.

Refrigerator marketers are targeting first-time buyers with smaller, budget-friendly models, often purchased on instalments. At the same time, they’re encouraging existing users to upgrade to newer, larger, and more technologically advanced units – half of which are expected to be replaced within the next decade.

“Refrigerators are no longer a luxury – they've become a necessity in both urban and rural areas,” one industry insider said, adding, “Three key changes have driven the refrigerator boom in rural Bangladesh: better access to electricity, more affordable prices thanks to local production, and wider distribution through growing dealer networks.”

This "cooling revolution" is visibly altering rural life. Fridge ownership among teachers, farmers, mothers, and dairy owners is enabling safer food storage, better health outcomes, and more efficient household management.

In areas where food preservation, nutrition, and healthcare are critical, refrigerators are helping to store milk, medicine, and perishable goods – fundamentally improving daily life. As the insider noted: “It’s not about status. It’s about necessity.”

The refrigerator market in Bangladesh has exceeded Tk100 billion in value and continues to grow at a robust annual rate of 15%. Among the models available, top-mount refrigerators remain the most popular, followed by bottom-mount types. Traditional frost models still lead the market, although no-frost variants are steadily gaining traction. Rural consumers, empowered by credit schemes and wider product availability, are increasingly exploring diverse models, from single-door to side-by-side units.

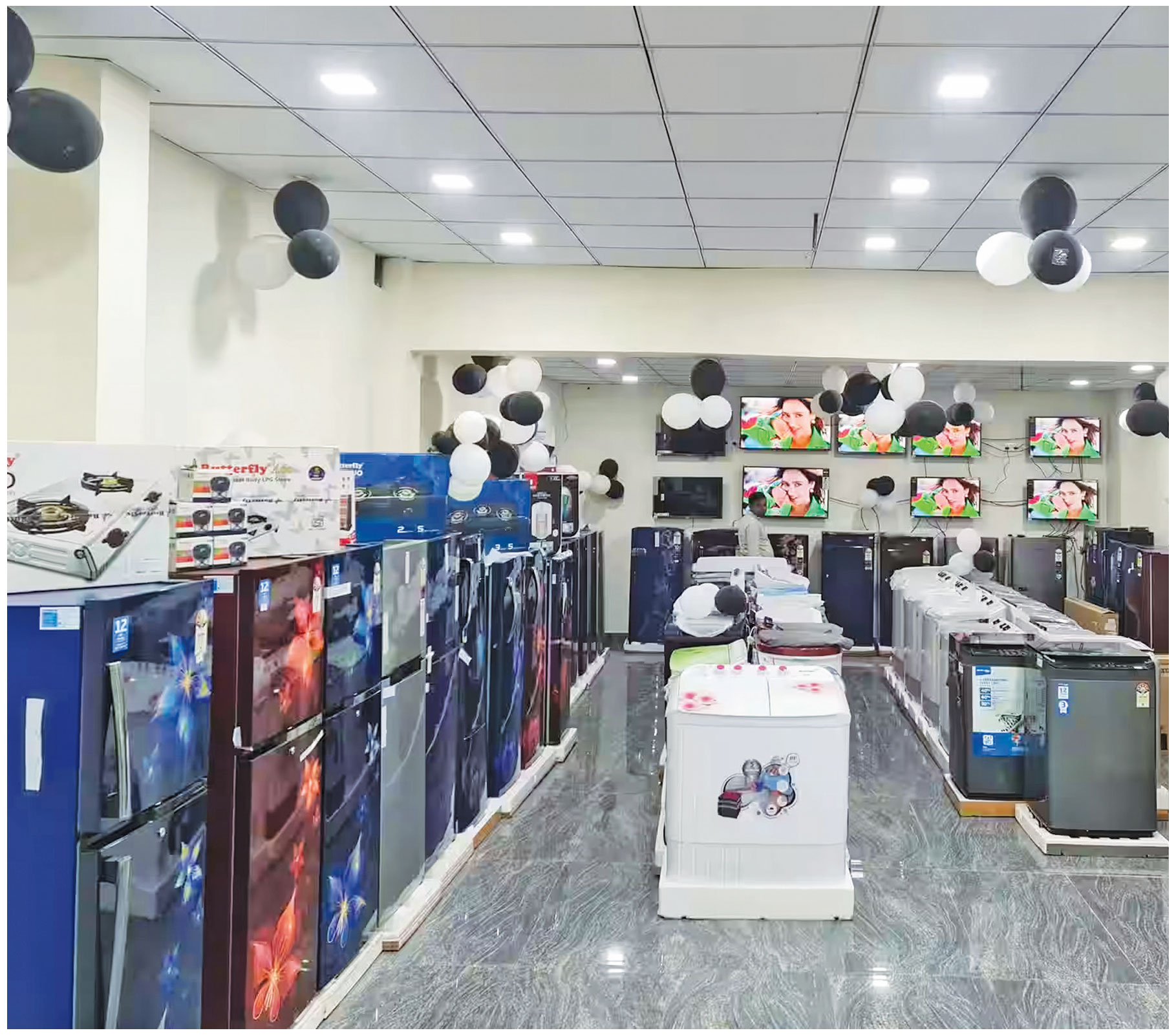

Much of the annual refrigerator sales – around 60% – occur during Eid festivals, particularly in the lead-up to Eid-ul-Azha. To capitalise on this demand spike, manufacturers and retailers roll out promotional offers, including discounts, digital campaigns, scratch cards, and 12-month instalment plans. Middle-class buyers, who primarily purchase units priced between Tk25,000 and Tk45,000, are the primary focus of these campaigns.

This year, manufacturers are especially targeting Eid-ul-Azha, which follows closely after the national budget session in early June. There are growing concerns in the industry that the government may increase VAT on refrigerators and other home appliances from the current 7.5% to 15% in the upcoming fiscal year – a move that could impact affordability for many buyers.

Walton, a major domestic player, has made early moves to maintain its competitive edge. The company continues to invest heavily in its R&D unit – the largest of its kind in South Asia – and is rolling out new, high-tech models.

“Refrigerators continuously monitor critical parameters to maintain food freshness. Using temperature data and artificial intelligence, the system determines the most suitable operating conditions at any given time,” Tahasinul Haque, chief business officer at Walton Refrigerator told the Daily Sun.

He added, “The refrigerator and freezer compartments can be converted based on user requirements, such as during holidays or when more refrigerator space is needed. Users can even diagnose technical issues before they become noticeable, which enables prompt service response.”

He also highlighted that Walton has introduced an Android LCD display control system with a built-in stereo sound system – pioneering features in the Bangladeshi market.

The rise of e-commerce platforms has also played a transformative role in this shift. With expanded logistics networks, online marketplaces have helped make refrigerators accessible even in remote rural areas. Bangladeshi expatriates are also leveraging these platforms to gift refrigerators to their families during festivals.

“Refrigerator sales are usually strong before Eid-ul-Azha. However, this year, we’ve noticed slower sales compared to recent years. It seems people are prioritising savings over spending. We hope the market normalises soon,” said Mohammad Russel, founder and CEO of Evaly, speaking to the Daily Sun.

He reported that Evaly has seen a 40% drop in refrigerator sales this Eid season compared to last year, likely due to ongoing inflationary pressures affecting household budgets.